jersey city property tax calculator

In New York City property tax rates are actually fairly low. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys.

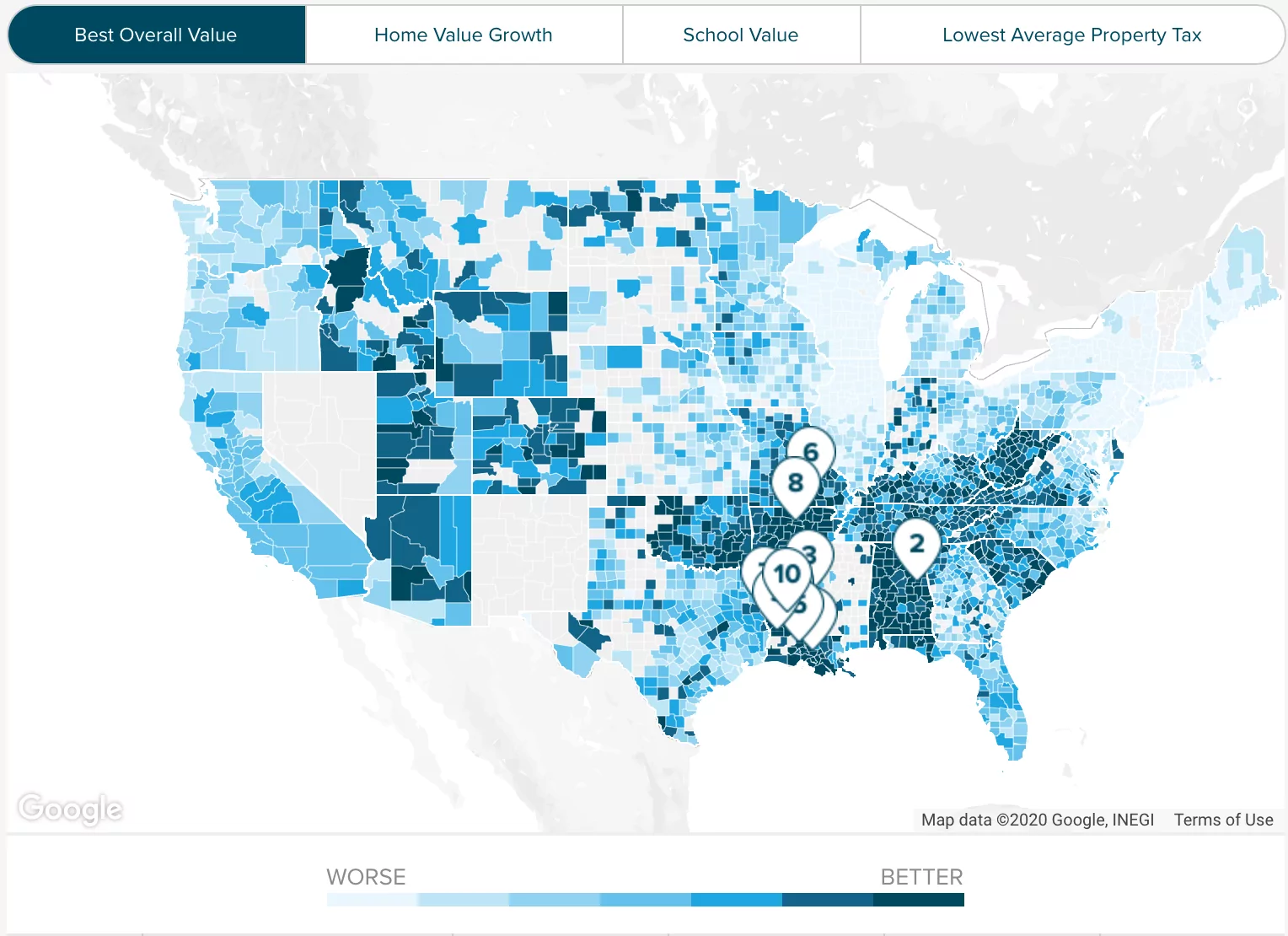

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

In fact many New York counties outside of New York City have rates exceeding 250 which is more than double the national average of 107.

. Select Advanced and enter your age to alter age. 11 rows City of Jersey City. Find All The Assessment Information You Need Here.

Box 2025 Jersey City NJ 07303. The average effective property tax rate in New Jersey is 242 compared to. All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land.

New Jerseys real property tax is an ad valorem tax or a tax according to value. Enter Your Salary and the Jersey Salary Calculator will automatically produce a salary after tax illustration for you simple. You pay tax at the lower of two calculations.

New Jersey has one of the highest average property tax rates in the country with only states levying higher property. See Results in Minutes. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements.

Checking Account Debit - Download complete and send the automated clearing house ACH Payment Authorization Form to the above address or. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Calculation of income tax.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Jersey County Tax. Jersey City establishes tax levies all within the states statutory rules. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

General Property Tax Information. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The marginal rate calculation.

The median property tax on a 29410000 house is 308805 in the United. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

By Mail - Check or money order payable to. TO VIEW PROPERTY TAX ASSESSMENTS. Property Tax Calculator - Estimate Any Homes Property Tax.

Online Inquiry Payment. In Person - The Tax Collectors office is open 830 am. Unsure Of The Value Of Your Property.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Revenue Jersey Taxes Office postal address. Purchase Price Purchase Price is the only field required.

If you live in Jersey and need help upgrading call the States of Jersey web team on 440099. Your yearly tax is calculated based on your total taxable income in the year less any deductions you can claim. 11 rows City of Jersey City.

Real estate evaluations are undertaken by the county. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. For comparison the median home value in Jersey County is 11820000.

City of Jersey City Tax Collector. For comparison the median home value in New Jersey is. Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period.

Ad Enter Any Address Receive a Comprehensive Property Report. King Drive 3rd floor Jersey City NJ 07305 email protected Edward Toloza CTA City Tax Assesor. There is also an exemption threshold where you dont pay tax if your income is below the threshold.

To view Jersey City Tax Rates and Ratios read more here. Office of the City Assessor City Hall Annex 364 ML. 280 Grove St Rm 101.

Several factors - like your marital status salary and additional tax withholdings - play a role in how much is taken out from your. Online Inquiry Payment. Revenue Jersey PO Box 56 St Helier Jersey JE4 8PF.

The average effective property tax rate in the Big Apple is just 088 more than half the statewide average rate of 169. The standard measure of property value is true value or market value that is what a willing. Follow these simple steps to calculate your salary after tax in Jersey using the Jersey Salary Calculator 2022 which is updated with the 202223 tax tables.

Below 100 means cheaper than the. For comparison the median home value in New Jersey is 34830000. Use this calculator to estimate your NJ property tax bill.

Federal income taxes are also withheld from each of your paychecks. How Your New Jersey Paycheck Works. 201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey.

The standard rate calculation.

The Outstanding Printable Home Inspection Report Template Elegant 2018 Home Intended For Property Management Inspectio Report Template Best Templates Templates

Tamil Nadu Property Tax Hike 25 50 Hike Covers About 83 Of Houses The Hindu

The Minimum Salary You Need To Be Happy In Every State Find A Job Can Money Buy Happiness Happy

14 Self Storage Marketing Ideas Marketing Ideas Storage And Cube Storage

Nyc Home Prices Plunge After Salt Deductions Capped

2022 Property Taxes By State Report Propertyshark

Riverside County Ca Property Tax Calculator Smartasset

13450 Quincy Street Ne Ham Lake Mn 55304 Mls 5665554 Themlsonline Com House Styles Kitchen Center Island Real Estate

5 Reasons To Sell Before The Selling Season Picks Up By Jeff Kram Things To Sell Austin Real Estate Selling Your House

New York Property Tax Calculator 2020 Empire Center For Public Policy

Township Of Nutley New Jersey Property Tax Calculator

Pin By Tu On Buildings Home Design Software Home Design Software Free House Exterior

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

U S Property Taxes Comparing Residential And Commercial Rates Across States

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Tax Bill Breakdown City Of Woodbury

Pin By D M Business Services On Www Woodaccounting Co Za Accounting Services Payroll Accounting